The Greatest Guide To Business Debt Collection

Corporate Debt Recovery Limited

vale park, Business Centre, Crab Apple Way, Evesham WR11 1GP, United Kingdom

+44 1386 895301

https://maps.app.goo.gl/HX4CW3KB6f5AiHaFA

Welcome to our blog post on Service Financial obligation Collection. In the world of company, debts can posture a significant difficulty to the monetary stability and success of a business. Reliable financial obligation collection methods are essential for making sure that your organization receives the funds it is owed in a timely manner. In this blog post, we will talk about the significance of service financial obligation collection, typical challenges faced by companies in this area, and practical ideas for enhancing your financial obligation collection processes. Whether you are a small business owner or a corporate executive, understanding how to effectively handle and gather debts is essential for the long-lasting success of your business. Stay tuned for valuable insights and professional recommendations on browsing the complex world of company financial obligation collection.

Comprehending the Financial Obligation Collection Process

The primary step in the debt collection process is usually a preliminary notice sent by the creditor or debt collector informing the debtor of the quantity owed and providing directions on how to address the debt. Small Company Financial obligation Collectors play a vital function in assisting organizations recuperate outstanding debts while maintaining positive relationships with their customers. These professionals utilize their proficiency in settlement and interaction to reach equally useful arrangements with debtors, making sure that overdue payments are gathered in a timely manner. By employing the services of a Small company Financial obligation Collector, business can focus on their core operations without the problem of chasing after unsettled invoices, ultimately improving their monetary stability and cash flow.

Also, it is important for organizations to comprehend the prospective consequences of non-payment by debtors. As pointed out previously, if initial efforts at debt collection are not successful and the debtor does not respond or make payment arrangements, lenders may have no choice but to escalate the scenario. This could include pursuing legal action through a commercial financial obligation recovery firm, which may lead to a court judgment against the debtor and more actions such as wage garnishment or possession seizure. For that reason, it is important for companies to have a strong understanding of their rights and choices when it comes to gathering debts in a prompt and effective manner. By being proactive and notified about the financial obligation collection process, services can safeguard their financial interests and preserve healthy capital.

Evaluating and Improving Financial Obligation Collection Strategies Frequently

Regularly evaluation and evaluate essential efficiency signs such as typical collection time and recovery rates to determine locations for improvement in debt collection techniques. In the world of business financial obligation healing, these metrics play a crucial role in examining the efficiency of collection efforts. By carefully keeping track of these indications, companies can get valuable insights into their debt collection procedures, enabling them to determine inadequacies and implement targeted solutions. This data-driven approach not just boosts the general effectiveness of financial obligation healing operations however likewise assists organizations enhance their cash flow and preserve healthy monetary stability.

Implement feedback loops with frontline personnel to collect insights on common challenges faced throughout the collection procedure and adjust strategies accordingly. Keeping a reliable approach to industrial financial obligation recovery requires a deep understanding of the complexities involved in the process. By actively soliciting feedback from workers straight engaged in the collection efforts, organizations can identify bottlenecks, fine-tune communication techniques, and simplify treatments. This iterative technique not just boosts functional efficiency but also strengthens the general financial obligation healing structure. By including feedback into the decision-making process, business can remain agile and responsive to the developing landscape of debt collection.

Moreover, by leveraging innovative technology solutions such as predictive dialers and client relationship management systems, industrial debt recovery processes can be streamlined and optimized for maximum performance. This not just enables a more smooth and orderly method to financial obligation collection, but also maximizes important time and resources for organizations. With the ever-evolving landscape of debt collection, incorporating these tools into workflows is crucial in staying ahead of the game. By using innovation to its complete capacity, business can enhance their success rates in recovering debts while maintaining an expert and effective method. In today's hectic company world, staying on top of business financial obligation healing through using technology is essential for ongoing development and success.

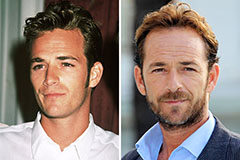

Luke Perry Then & Now!

Luke Perry Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!